[SINGAPORE] The trustee-manager of Stoneweg European Business Trust – a part of Stoneweg Europe Stapled Trust (Sert) – announced on Tuesday (Jun 24) that it has made a 50 million euros (S$74.4 million) investment in the Stoneweg Icona data-centre (IDC) fund.

Its stake in the fund is expected to range from 4 to 8 per cent, depending on the final quantum of investment made by the other investors.

The data center portfolio comprises interests in four early-stage data center development sites of 225 hectares in total size located in Ireland, Spain, Italy, and Denmark. These locations possess a secured 1,116 megawatt (MW) of power, with very good visibility for an additional 563 MW, for a total of 1,679 MW.

At this level, the IDC would command a share of the current European operational power capacity which exceeds 14 per cent, and would be the largest data center operator in the region.

The current estimated gross development value over the next 15 years is 29.5 billion euros at current market values for the 100 per cent interest in all four projects, according to valuer JLL.

The assets are projected to reach a gross development value of 29.5 billion euros over 15 years, to position the platform to become Europe’s largest data centre operator by power capacity.

This is SWI Group’s – comprising Stoneweg, Icona Capital, its subsidiaries, and associates –first transaction since it became the sponsor of Sert at the end of 2024.

Earlier on Jun 4, the manager of Stoneweg E-Reit announced that the Reit will be converted into a stapled group. This meant that each unit of Stoneweg E-Reit would be stapled to a unit in Stoneweg European Business Trust, to form a stapled security in Sert, following the approval of unitholders at a general meeting held on Apr 29.

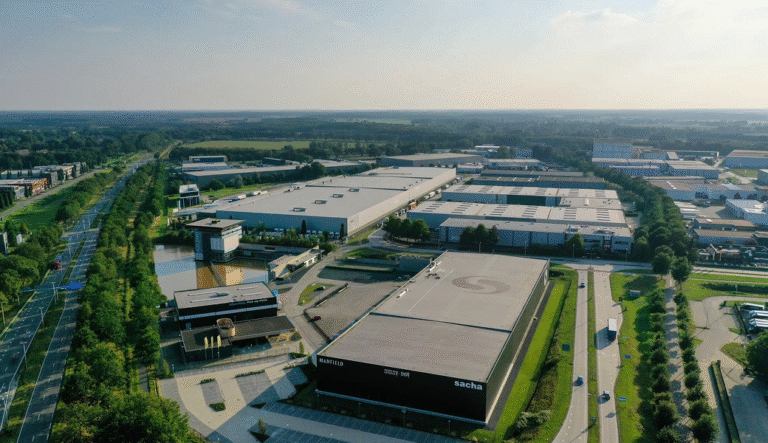

The move also complements the stapled trust’s existing data center holdings in Denmark and Poland, so as to diversify into high-growth infrastructure assets alongside its logistics and light industrial portfolio.

The counter ended flat at 1.52 euros on Monday.